GLOMO

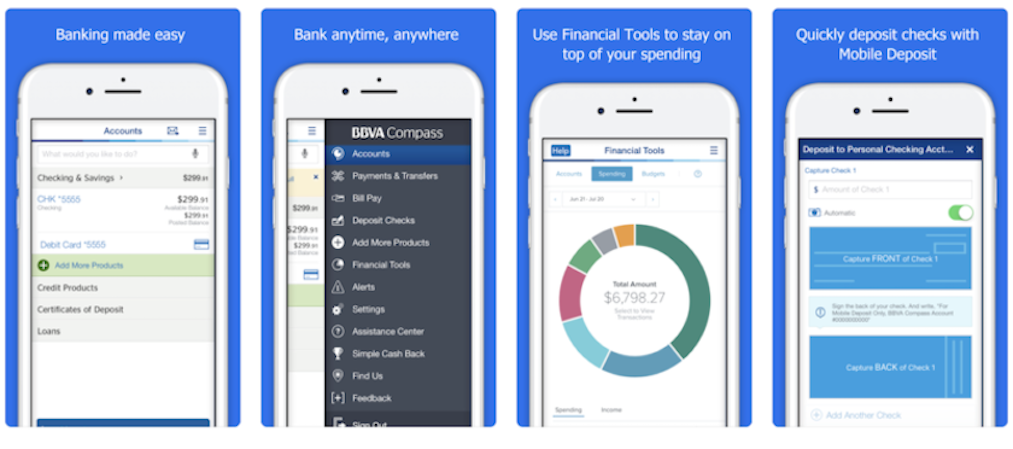

Consoaring Inc. has been developing a consumer-based application for the past three years for BBVA and the current developments have shown just how much progress has been made. GLOMO, or Global Mobile Initiative, is a single application for customers of BBVA in multiple countries to use and be able to access banking features. The mobile banking application will provide critical, necessary information to consumers related to deposits, payments with QR codes, balances, ATM transactions using mobile codes, and other related consumer features.

The Challenge

The challenge for BBVA, and in specific our candidate’s development team, was to create a single application for customers of BBVA in multiple countries to use and be able to access banking features. Our developer worked on the application designed for BBVA’s consumers in Mexico.

The Solution

The solution for the BBVA application was to produce purposeful actions for needed consumer responses. The mobile app and server needed to interact well, with the end goal of getting all bank services, updates, notifications for the consumer. Reactive architecture was implemented to establish communication channels and look for events occurring in the application to then react to their events effectively. The Houston team, including our developer, worked with iOS primarily and used the most current Swift updates to improve development processes. However, the architecture of design and development was a Native Team Interaction using Hybrid code. The development team used HTML, CSS, and JavaScript integration to avoid developing separate iOS and Android applications. Both iOS and Android applications were able to be used with hybrid development. By developing in this way, the team created Native features that allowed for communication between mentioned hybrid technologies, essentially the server and the consumer. Further down the development stage, it was decided that this architecture of hybrid technology was a bad idea, so it was scrapped. As HTML and JavaScript integration is made UI features and development more complicated, BBVA learned as a company about their preferred mobile development processes.

The Benefits

This application is the basis for future interaction between the consumer, BBVA, and its technology. The end result was to produce a consumer application that would allow customers of BBVA in multiple countries to use and be able to access banking features. From both developer and consumer feedback, the UI was developed thoroughly and is transformative compared to the competition. Meaning all the shapes, colors, and transaction processes have been fine-tuned to provide cutting-edge feedback and interaction. And UI transformations have unique animations, providing the consumer with a modern and high-definition response and feeling to each interaction with the application. BBVA plans to direct this application in a full-hybrid technology-based route to streamline development processes and costs of development.